Project Title: An Integrated CVaR and Real Options Approach for Measuring the Impact of Earth Observations in the Energy Sector

Collaborating GEO-BENE partners: IIASA (leader)

Background

Lack of earth observation data implies that policymakers are not sufficiently informed about climate sensitivity, which in turn means that climate change policies are vague as well: Such policies, which we model here through the CO2 price, might be adapted as new information becomes available and may thus be too high or too low temporarily. While the real options approach from the first project focuses on the impact of such uncertainty at the plant level, it is also important to know how a large energy company, region or country copes with these conditions. Different technologies bear different degrees and types of risk and the large “investor” will therefore want to diversify, so we use the return distributions generated by the real options model in a portfolio optimization with the Conditional Value-at-Risk as risk-measure. The next step is to consider that if the investor does not know, which CO2 price scenario will materialize, then he/she will want to compose the generating portfolio such that it has minimal risk at a specified return constraint (or vice versa) across all possible scenarios. In other words, we compute the optimum portfolios in each scenario and compare them to the optimum portfolio, which is robust for all scenarios. The difference in returns will show us how valuable earth observation data (helping to formulate clear and stable CO2 price paths) are.

Data

The dataset used for this study is based on a survey by the International Energy Agency (IEA, 2005. “Projected costs of generating electricity – 2005 update.” OECD/IEA, Paris). The projections for CO2 prices and electricity prices were derived from the GGI Scenario Database (IIASA, 2007: available at http://www.iiasa.ac.at/Research/GGI/DB/ ), where the trend of the former is based on the GHG shadow prices provided in the database.

Methods

A real options model is used for the assessment of investments at the plant level, i.e. the timing of investment and subsequent operations. The resulting return distributions are then used as an input for the portfolio model. Since statistical tests involving the use of copulas show that normality of return distributions is not given, we refrain from using the standard mean-variance portfolio optimization method and opt for another risk measure taking into account the tails of the distributions as well: the Conditional Value-at-Risk (CVaR). We minimize the risk given a constraint on returns, but this could also be done the other way around, of course. The next step is the computation of the optimum CVaR-portfolios for three different scenarios with high, low and medium CO2 prices. The resulting returns are then compared to the optimum portfolio that would be robust across all three scenarios, which is achieved by solving the corresponding minimax problem. This shows what the value of obtaining earth observations would be in terms of better informed climate change policy, which would also lead to a more secure investment environment in the energy sector.

Results

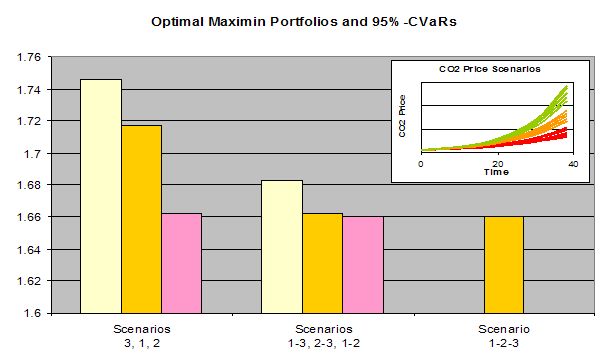

Figure 1 below shows that the optimum portfolios per scenario all have a higher return than optimum portfolios that have to be robust across scenarios 1 and 2, 1 and 3, and 2 and 3. The optimum portfolio that is robust across all three scenarios has the lowest return of all. The magnitude of this difference changes, of course, as other scenarios are considered and different parameters for the involved processes tested, but it is obvious that there is a quite significant portion of return, which gets lost due to missing earth observation date that would deliver more insight about climate sensitivity and thus make CO2 price policy more predictable and less volatile.

Status

A manuscript entitled ‘An Integrated CVaR and Real Options Approach to Investments in the Energy Sector’ by Ines Fortin, Sabine Fuss, Jaroslava Hlouskova, Nikolay Khabarov, Michael Obersteiner and Jana Szolgayova will be published in the Journal of Energy Markets 1(2) in the summer of 2008. Fig. 1: The first group of bars shows the optimum portfolios’ returns if the investor knows, which CO2 price scenario (see small panel in the right-hand corner of the figure) materializes. If it is only known that scenarios 1 or 3, or 2 or 3, or 1 or 2 will materialize the returns are already lower. The last bar shows the optimum portfolio robust over al scenarios, which also has the lowest return. Much can thus be gained by not adapting climate change policy later, as new earth observations become available, but by reducing this kind of uncertainty by having such observations earlier on.

Fig. 1: The first group of bars shows the optimum portfolios’ returns if the investor knows, which CO2 price scenario (see small panel in the right-hand corner of the figure) materializes. If it is only known that scenarios 1 or 3, or 2 or 3, or 1 or 2 will materialize the returns are already lower. The last bar shows the optimum portfolio robust over al scenarios, which also has the lowest return. Much can thus be gained by not adapting climate change policy later, as new earth observations become available, but by reducing this kind of uncertainty by having such observations earlier on.