Collaborating GEO-BENE partners: IIASA (leader), RAV

Background

Risk management is at the heart of insurance. Yet, as insurance uptake particularly in developing countries is low due to among other things the substantial costs of insurance, novel products are being developed utilizing index-based approaches, where the claim payment is not based on the individual losses, but on physical signals, such as rainfall and the lack thereof. Microinsurance is one of insurance, which aims at managing risks for the poor through increased stakeholder coordination and information sharing between donor organisations, multilateral agencies, NGO’s etc. To make this instrument cost-effective, index-based microinsurance is currently being developed in Asia, Latin America and Africa. The event triggering the payment of loss compensations is an easy-to-observe objective event, such as measurements of atmospheric or seismic activities by an independent observatory exceeding some threshold. While this kind of event triggering is easy to implement, cheap and not subject to moral hazard, it might be ineffective, if the real loss is not highly correlated to the triggering event. There is a fundamental tradeoff in such kind of instruments: Easy-to-observe events are not highly correlated to the real loss, but well correlated events are not easy to observe. The question is whether new technologies of remote sensing may alleviate this dilemma: By observing smaller areas with better resolution, the triggering event for a certain region may be very local and therefore better correlated with the damages in that region.

Data

Daily Rainfall amount from 1961 till 2005 from Chitedze station. PRECIS rescaled projections (monthly rainfall) of the control and future period. Control is January1960 to December 1979. Future is January 2070 to December 2089. MM5 rescaled projections (monthly rainfall) of the control and future period. Control is from January 1975 to December1984. Future is January 2070 to December 2079

Methods

Monte Carlo simulation, dynamic financial analysis.

Results

Phase 1:

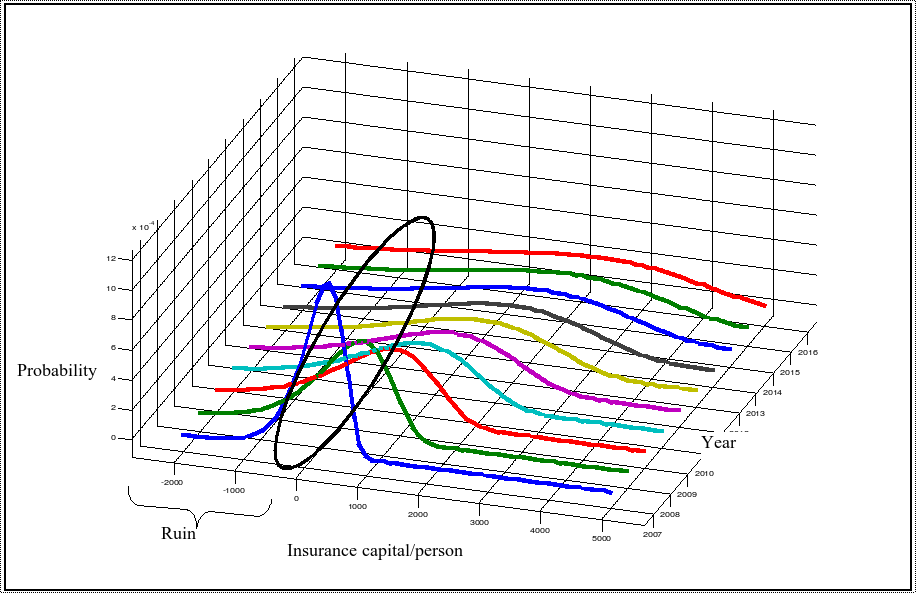

Based on rainfall data as well as climate scenarios up to 2100 for a village in Malawi various possible problems of micro-insurance were tackled. For example, the figure below show the catastrophe risk of insurers in this region, if climate change signals are not taken into consideration.

Figure: Simulated trajectories of insurance pool’s capital in the near future

Based on extreme value theory the benefits in the case of extremes were assessed. In conclusion heavier tails are likely to be expected in the future, which in turn would lead to higher probabilities of an insurers ruin, due to the underestimation of the direct risk.

Phase 2

In phase 2 other benefit areas will be assessed in a quantitative manner too. The benefits of additional data or more detailed data is investigated on the country level as well. Furthermore, the very important “basis risk” for microinsurance is looked at. Here, it is assumed that the basis risk can be decreased due to better land use information and incorporating El Nina and El Nino effects.