Project Title: Impact of Climate Policy Uncertainty on the Adoption of Electricity Generating Technologies

Collaborating GEO-BENE partners: IIASA (leader)

Background

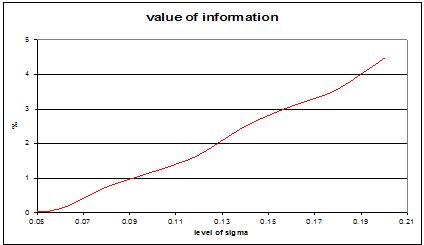

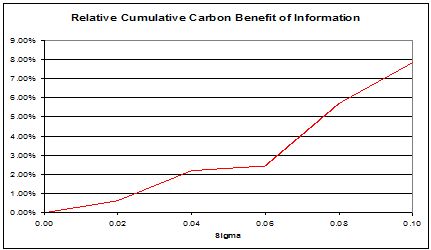

Investments in the electricity sector are characterized by uncertainty about future climate change policy (here modelled as stochastic CO2 price), irreversibility and flexibility to time the installation of new capacity and its operation optimally, which makes a real options approach very attractive to assess investments. In this study, we find in addition that real options techniques offer a sophisticated way of computing the value of information – and the value of earth observations in the case of GEO-BENE, which will lead to better informed climate change policy (e.g. through enhanced insights on climate sensitivity) and thus stable CO2 prices. By comparing profits of electricity producers acting optimally under uncertainty to those generated under certainty, we can assess the value of information in terms of electricity sector profits. In the same way, we can compare the emissions generated when optimizing under uncertainty to the emissions when there is no uncertainty and derive the value of information in terms of environmental benefits, or – more precisely – emissions saved by having better informed policy and therefore more stable CO2 prices.

Data

The dataset used for this study is based on a survey by the International Energy Agency (IEA, 2005. “Projected costs of generating electricity – 2005 update.” OECD/IEA, Paris). The projections for CO2 prices and electricity prices were derived from the GGI Scenario Database (IIASA, 2007: available at http://www.iiasa.ac.at/Research/GGI/DB/ ), where the trend of the former is based on the GHG shadow prices provided in the database. Additional information about carbon capture and storage technologies and the involved costs can be found in the IPCC special report on CCS (http://arch.rivm.nl/env/int/ipcc/pages_media/SRCCS-final/IPCCSpecialRepo...).

Methods

A real options model, where multiple (technology) options are assessed in one and the same framework, is used. There are three technology options considered in the model. These technologies are chosen to represent a wider range of possible technologies. The technologies we consider are (1) a coal-fired power plant, in our case Integrated Gasification Combined Cycle (IGCC), (2) the option to retrofit this plant with a module that captures the carbon and which includes the necessary infrastructure to transport the carbon to a “safe” storage, hence a Carbon Capture and Storage (CCS) module, and (3) a wind farm. These three technologies can be seen as representative technologies of the current system, an intermediate change in the current system and a radically new system, where the latter features high capital costs. We evaluate the options in the presence of each other in order to capture one option’s existence’s effect on the value of the other options, which can change the optimal investment behaviour significantly. As a solution method, Monte Carlo simulations are used.

Results

The real options approach is a useful framework for the estimation of the value of information/earth observations in terms of producer/investor profits and environmentally in terms of emissions saved. However, it is important to keep in mind that all technology options have to be valued simultaneously, i.e. not independently, to capture the full effects and model investment behavior realistically.

For GEOBENE, the most important result is that more certainty about climate sensitivity through the acquisition of better earth observation data will lead to better informed climate change policy and thus more stable CO2 prices. This leads to a higher value of information according to both criteria used in this study: there are gains for producers/investors and reduced emissions.

Status

A manuscript entitled ‘Impact of Climate Policy Uncertainty on the Adoption of Electricity Generating Technologies’ by Sabine Fuss, Daniel Johansson, Jana Szolgayova and Michael Obersteiner has been submitted for publication at Energy Policy (as of April 2008).

Fig. 1: Relative expected value of information in monetary terms for increasing CO2 price volatility with continuous fluctuations (GBM) (This represents the fraction that an investor would be willing to pay in order to know the price path ex ante).

Fig. 2: Fraction of CO2 Avoided under Certainty